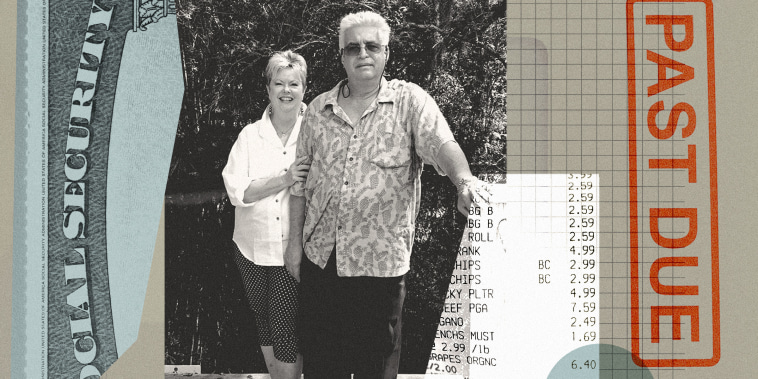

The mentioned article highlights the struggles faced by a retiree in Florida who is living off $2,400 a month after her savings were drained. This situation is unfortunately not uncommon, with many retirees finding themselves in a similar financial predicament due to various reasons such as unexpected expenses, inadequate retirement planning, or economic challenges. While the specifics of each individual’s circumstances may vary, the underlying issue of financial insecurity during retirement is a pressing concern that needs to be addressed at both personal and societal levels.

One key aspect that emerges from this story is the importance of careful financial planning and budgeting throughout one’s life. Retirement planning should ideally start early, with consistent efforts to save and invest wisely to build a nest egg that can sustain an individual during their later years. This involves setting clear financial goals, monitoring expenses, and making informed decisions about investments to ensure a comfortable retirement.

Another critical factor is the need for adequate social safety nets and support systems for retirees who may find themselves in financial distress. Government programs such as Social Security and Medicare play a crucial role in providing essential benefits for retirees, but there are often gaps that need to be filled through personal savings or other means. It is essential for policymakers to address these gaps and ensure that retirees have access to affordable healthcare, housing, and other necessities to maintain a decent quality of life in retirement.

Moreover, the case of the Florida retiree underscores the importance of having a diversified income stream during retirement. Relying solely on savings or a fixed pension may not be sufficient to cover all expenses, especially with the rising cost of living and healthcare. Exploring options such as part-time work, rental income, or passive investments can help supplement retirement income and provide a buffer against unexpected financial challenges.

In addition to financial considerations, the emotional and psychological aspects of retirement should not be overlooked. Adjusting to a fixed income, especially after a period of financial stability, can be stressful and demoralizing for retirees. It is important for individuals in this situation to seek out emotional support, whether through counseling, social groups, or family and friends, to navigate the challenges of living on a limited budget and find fulfillment and purpose in their retirement years.

Ultimately, the story of the Florida retiree serves as a reminder of the importance of proactive financial planning, social support, and emotional resilience in ensuring a secure and fulfilling retirement. By addressing these key aspects, individuals can better prepare themselves for the financial uncertainties of retirement and enjoy their golden years with peace of mind and dignity.