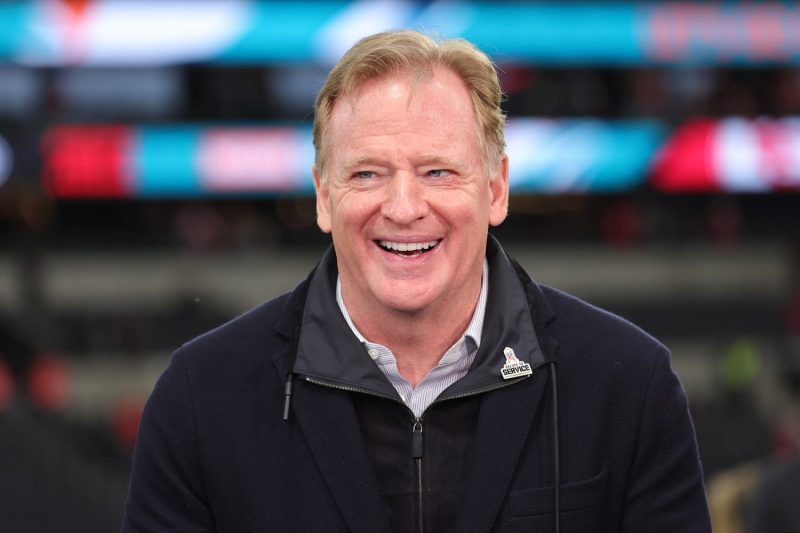

The National Football League (NFL) has long been the premier professional American football league in the world, and its status as a multi-billion dollar industry has made it an attractive prospect for investors seeking opportunities in sports ownership. A recent development within the league has garnered attention – the NFL is open to the idea of private equity firms owning stakes in its teams. Commissioner Roger Goodell has signaled that the league would be willing to allow up to 10% of team ownership to be held by private equity investors.

Private equity firms are investment management companies that raise funds from high-net-worth individuals and institutional investors to acquire equity ownership in companies. Typically, they aim to improve the performance of their portfolio companies over a specific period before seeking to sell or exit the investment at a profit. In the context of the NFL, private equity ownership of teams could bring both benefits and challenges to the league and its franchises.

One of the primary advantages of private equity investment in NFL teams is the potential infusion of capital. Private equity firms often have significant financial resources at their disposal, which could be used to support team operations, stadium development, player acquisitions, and other strategic initiatives. This injection of capital could enhance the competitiveness and financial stability of the teams involved, ultimately benefiting the league as a whole.

Furthermore, private equity investors could bring valuable expertise and strategic guidance to NFL teams. These firms typically have experienced professionals with a track record of driving operational efficiencies and maximizing value in their investments. By leveraging their expertise in areas such as management, marketing, and revenue generation, private equity owners could help teams optimize their performance both on and off the field.

However, the prospect of private equity ownership in the NFL also raises important considerations and potential challenges. One major concern is the long-term alignment of interests between private equity investors and the league’s core values. The NFL has traditionally operated under a model of collective ownership, with team owners working together to promote the league’s brand and uphold its integrity. Introducing private equity stakeholders with profit-driven motives could potentially disrupt this collective ethos and lead to conflicts of interest.

Moreover, there are questions about the transparency and governance implications of private equity involvement in NFL teams. Private equity firms often operate with a level of confidentiality and autonomy that may not align with the league’s existing regulatory framework and policies. Ensuring that private equity owners adhere to the NFL’s rules and standards, particularly regarding player welfare, competitive balance, and financial transparency, will be crucial to maintaining the integrity of the league.

In conclusion, the NFL’s openness to private equity team ownership represents a significant shift in the landscape of professional sports ownership. While private equity investment could bring financial resources, expertise, and innovation to NFL teams, it also poses challenges related to governance, transparency, and cultural alignment with the league’s values. As the NFL navigates this new frontier of ownership structure, careful consideration and collaboration between league officials, team owners, and private equity investors will be essential to ensuring the long-term success and sustainability of the league.