Investing with the Trend – An Effective Strategy for Long-Term Success

Understanding financial markets and finding ways to capitalize on market trends is essential for successful investing. One strategy that has proven to be effective over time is investing with the trend. By identifying and following prevailing market trends, investors can significantly increase their chances of success in the stock market.

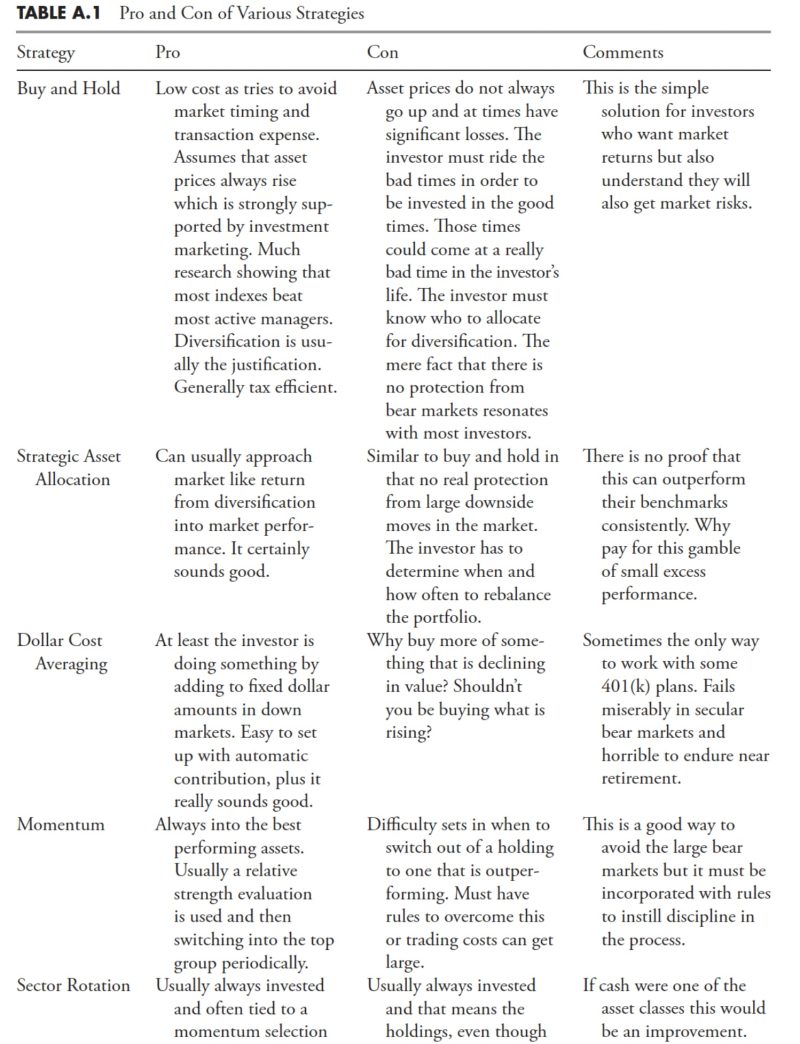

Trend-following investing involves identifying the direction in which a particular asset or market is moving and then aligning one’s investment decisions with that trend. This approach is based on the belief that markets have a tendency to move in consistent and identifiable patterns over time. By recognizing and following these trends, investors can potentially capitalize on the momentum and secure profitable returns.

The first step in investing with the trend is to identify the prevailing trend in the market or asset one is interested in. This can be done by analyzing historical price data, technical indicators, and market sentiment. Trends can be classified as upward (bullish), downward (bearish), or sideways (neutral). Identifying the trend early on is crucial as it allows investors to position themselves strategically and take advantage of potential gains.

Once the trend has been identified, investors can then enter the market by buying or selling assets based on the direction of the trend. In a bullish trend, investors would look to buy assets with the expectation that prices will continue to rise. Conversely, in a bearish trend, investors would look to sell assets to profit from falling prices. It is important to note that trend-following strategies are not foolproof and that there are risks involved, including the potential for false signals and market reversals.

To effectively implement a trend-following strategy, investors should also consider risk management and position sizing. Diversification across various asset classes and regions can help mitigate risk and protect against market volatility. Setting stop-loss orders and using trailing stops can also help protect profits and limit losses in case the trend reverses.

One of the key benefits of investing with the trend is that it allows investors to capitalize on the momentum of the market and ride the wave of profitable opportunities. By aligning one’s investment decisions with the prevailing trend, investors can potentially achieve consistent returns over the long term. Additionally, trend-following strategies are relatively simple to implement and do not require in-depth knowledge of the underlying fundamentals of the market.

In conclusion, investing with the trend is a proven strategy that can help investors navigate the complexities of the stock market and increase their chances of success. By identifying and following prevailing market trends, investors can position themselves strategically and capitalize on profitable opportunities. While trend-following strategies are not without risks, they offer a systematic approach to investing that can lead to long-term financial success.