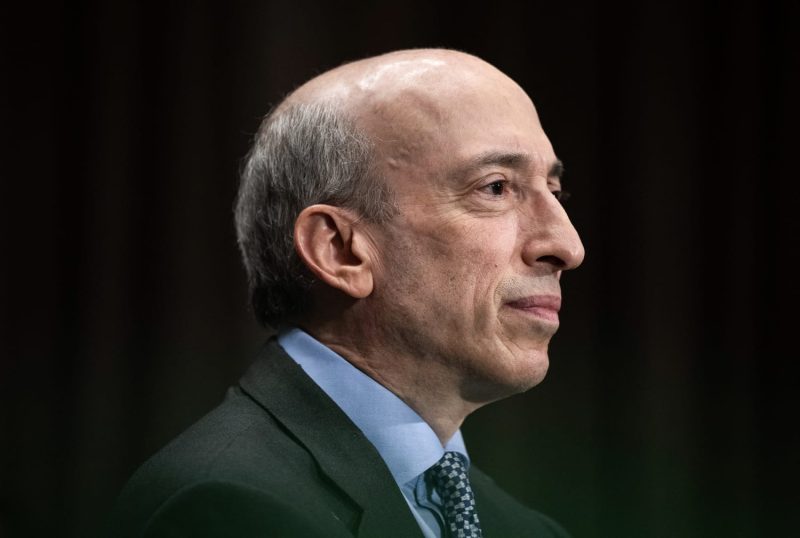

In an unexpected turn of events, Securities and Exchange Commission (SEC) Chair Gary Gensler recently announced his decision to step down from his position effective January 20, paving the way for a potential replacement appointed by former President Donald Trump. Gensler’s departure comes at a crucial time for the SEC as it navigates various challenges in the financial markets and regulatory landscape.

During his tenure at the SEC, Gary Gensler made significant strides in enhancing transparency and accountability in the financial sector. Gensler, a former Goldman Sachs executive turned Wall Street watchdog, brought a wealth of expertise and experience to his role, championing investor protection and market integrity.

One of Gensler’s key accomplishments as SEC Chair was his focus on cryptocurrency regulation. He pushed for greater oversight of digital assets and worked towards establishing a regulatory framework to govern this rapidly evolving sector. Gensler’s efforts in this area were met with both praise and criticism, reflecting the complexity and sensitivity of regulating innovative financial technologies.

Under Gensler’s leadership, the SEC also intensified its scrutiny of special purpose acquisition companies (SPACs) and blank-check offerings. Gensler raised concerns about the potential risks associated with SPACs, highlighting the need for stricter disclosure requirements and investor safeguards. His proactive stance on SPAC regulation underscored his commitment to protecting investors from speculative and opaque investment practices.

Furthermore, Gensler prioritized environmental, social, and governance (ESG) factors in corporate disclosures and decision-making. He advocated for greater transparency around companies’ sustainability initiatives and urged corporate leaders to integrate ESG considerations into their strategic planning processes. Gensler’s emphasis on ESG disclosure reflects the growing recognition of sustainability as a critical aspect of long-term business success and stakeholder confidence.

As Gary Gensler prepares to leave the SEC, the financial industry awaits the appointment of his successor by the Trump administration. The incoming SEC Chair will inherit a diverse set of challenges, including addressing emerging risks in the digital asset space, refining SPAC regulations, and advancing ESG integration in corporate governance.

In conclusion, Gary Gensler’s tenure as SEC Chair has left a lasting impact on the regulatory landscape, shaping key policy initiatives and driving forward critical reforms. His legacy will be defined by his unwavering commitment to investor protection, market transparency, and regulatory innovation. As the SEC transitions to new leadership, the financial community will closely monitor the agency’s continued efforts to uphold integrity and accountability in the capital markets.