The article discusses the current situation of the USD in the context of a potential rally. It provides insights into the factors that could influence the USD’s value in the near future and the implications of a USD rally on the global economy.

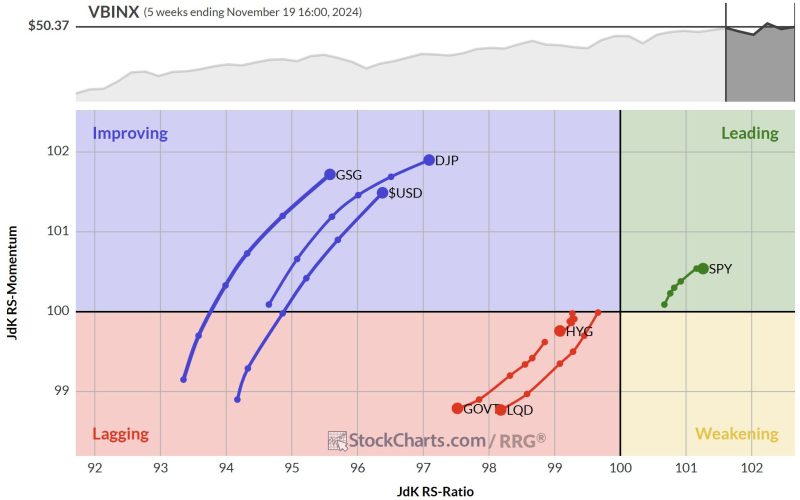

The USD has been facing pressures due to various factors, including the Federal Reserve’s monetary policy stance and geopolitical tensions. However, recent data and developments suggest that the USD may be setting up for a rally. The article analyzes these factors and their potential impact on the currency.

One key factor contributing to the potential rally of the USD is the Federal Reserve’s hawkish stance on monetary policy. The Fed has signaled its intention to raise interest rates in response to rising inflation and strong economic data. Higher interest rates generally attract foreign investors looking for higher returns on their investments, which could increase demand for the USD and strengthen its value.

Geopolitical tensions and uncertainties have also been influencing the USD’s value. The US-China trade war and political instability in various regions have added to the uncertainty in global markets. In times of geopolitical risks, investors often seek safe-haven assets such as the USD, which could further support its rally.

Moreover, the USD’s status as the world’s primary reserve currency also plays a significant role in its value. Central banks and global investors hold a substantial amount of USD-denominated assets, which lends stability to the currency. In times of uncertainty, the USD tends to benefit from its safe-haven status, attracting investors seeking a secure store of value.

The potential rally of the USD could have widespread implications for the global economy. A stronger USD could impact various asset classes, including commodities and emerging market currencies. Commodities such as oil and gold are typically priced in USD, so a rising dollar could put pressure on commodity prices. Emerging market economies that have borrowed in USD could face challenges servicing their debt if the dollar strengthens significantly.

Overall, the article highlights the factors contributing to the potential rally of the USD and the implications of a stronger dollar on the global economy. While the USD’s outlook is influenced by various factors, including monetary policy decisions and geopolitical developments, investors are advised to closely monitor these factors to gauge the currency’s future trajectory.