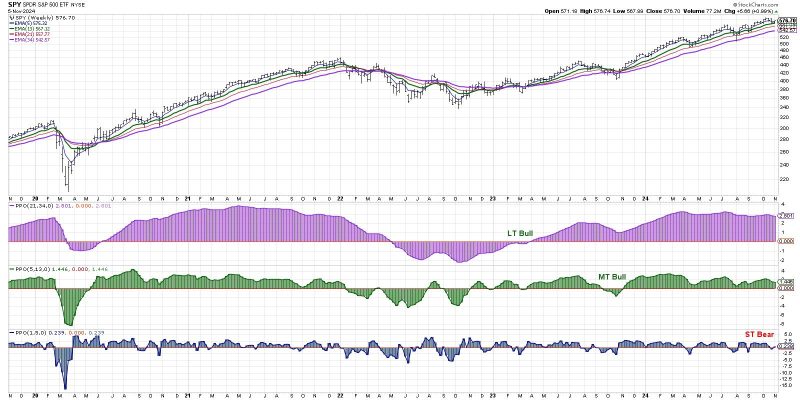

The article delves into the recent market trends and suggests a short-term bearish signal as investors brace themselves for a week filled with significant news releases and economic updates. The article highlights the importance of keeping a close eye on these developments to make informed investment decisions in the volatile market environment.

The article mentions that as investors await news regarding the Federal Reserve’s monetary policy and potential interest rate hikes, market sentiment appears to be shifting towards a more cautious outlook. This uncertainty has led to some short-term bearish signals in the market, indicating that investors may be preparing for potential downside risks.

Furthermore, the article points out that geopolitical tensions, varying inflation rates, and concerns about economic growth have contributed to the cautious approach adopted by investors. These factors have caused fluctuations in market indices and heightened volatility in various sectors.

The article emphasizes the importance of risk management strategies and maintaining a diversified portfolio during such uncertain times. It encourages investors to stay informed about economic indicators, news releases, and geopolitical events that can impact market dynamics significantly.

In conclusion, the article suggests that investors need to remain vigilant and prepared for potential market corrections in the short term. By closely monitoring news updates and economic developments, investors can position themselves to navigate through the evolving market landscape successfully.