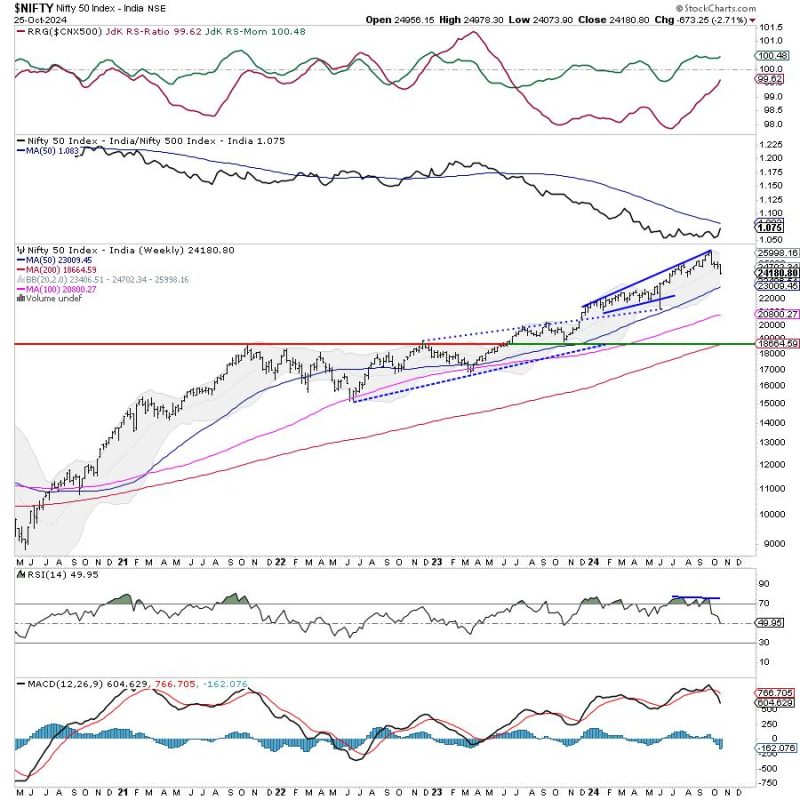

The article discusses the recent performance of the Nifty index in the stock market and analyzes the key support and resistance levels. The Nifty index faced a bearish trend and broke below the key support levels, thereby dragging the resistance levels lower. This decline in the Nifty index indicated a shift in market sentiment towards bearishness, leading to increased pressure on the index.

Technical analysis revealed that the Nifty index violated crucial support levels, including the 50-day moving average, which further added to the negative sentiment in the market. The breach of these support levels indicated a weakening trend and suggested that the index might continue to face downward pressure in the coming days.

The article highlighted the importance of closely monitoring the resistance levels in such a scenario. The resistance levels were pushed lower due to the breach of key support levels, and it was crucial for investors to observe how the index reacts to these newly formed resistance levels. A possible retest of the resistance levels could provide valuable insights into the future direction of the Nifty index.

In addition, the article emphasized the significance of risk management and stop-loss strategies in times of market uncertainty. Investors were advised to stay cautious and consider implementing risk mitigation measures to protect their investment portfolios from potential losses.

Overall, the article provided a comprehensive analysis of the recent performance of the Nifty index and offered valuable insights into the key support and resistance levels that investors should keep an eye on. By closely monitoring these levels and practicing effective risk management strategies, investors could navigate through the volatile market conditions and make informed decisions about their investment portfolios.