American Tower is a well-known company in the telecommunications infrastructure sector, and its recent performance indicates a significant breakout in its stock value. This development presents an excellent opportunity for investors seeking to capitalize on the growing demand for communication services worldwide. In this article, we will delve into the factors contributing to American Tower’s breakout and explore why this is a trend worth considering for savvy investors.

1. **Strong Financial Performance**: American Tower’s impressive financial performance is a key driver behind its current breakout. The company has consistently delivered solid revenue and profit growth, reflecting its robust business model and strategic positioning in the telecommunications industry. This stability and growth potential are attractive qualities for investors looking for long-term value.

2. **Global Expansion and Diversification**: A notable factor contributing to American Tower’s breakout is its strategic focus on global expansion and diversification. The company has a strong presence in key markets worldwide, providing essential infrastructure for mobile operators to enhance their network coverage and capacity. This global reach gives American Tower a competitive edge and resilience against economic fluctuations in any single market.

3. **Rising Demand for Mobile Data**: The increasing demand for mobile data services is a significant tailwind for American Tower. With the proliferation of smartphones, IoT devices, and emerging technologies like 5G, the need for robust telecommunications infrastructure has never been greater. American Tower is well-positioned to benefit from this trend, as mobile operators rely on its tower assets to support their network expansion and upgrade efforts.

4. **Focus on Innovation and Sustainability**: American Tower’s commitment to innovation and sustainability is another factor driving its breakout. The company is constantly investing in technological advancements and eco-friendly practices to optimize its operations and reduce its environmental impact. This forward-thinking approach resonates well with investors who prioritize companies with a strong focus on innovation and ESG principles.

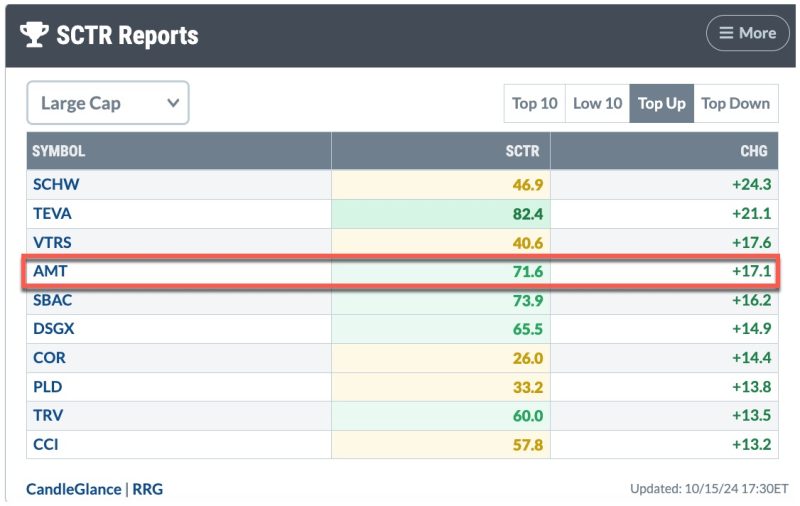

5. **Analyst Recommendations and Market Sentiment**: Analysts are increasingly bullish on American Tower’s prospects, with many rating the stock as a strong buy or outperform. This positive sentiment reflects the market’s confidence in the company’s growth trajectory and ability to navigate evolving industry dynamics successfully. As investor interest continues to grow, American Tower’s breakout momentum is likely to attract further attention from institutional and retail investors alike.

In conclusion, American Tower’s breakout is a compelling opportunity for investors seeking exposure to the telecommunications infrastructure sector’s growth potential. With its strong financial performance, global presence, and focus on innovation, the company is well-positioned to capitalize on the rising demand for mobile data services and emerge as a leader in the industry. By staying informed and conducting thorough due diligence, investors can potentially benefit from American Tower’s breakout and enjoy the rewards of a well-performing investment in the dynamic world of telecommunications.