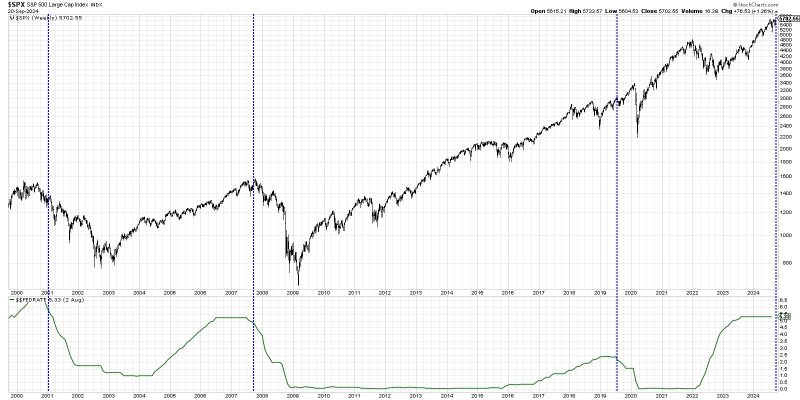

Rate cuts have been a topic of debate and speculation within the realm of stock performance for many years. With investors constantly analyzing the potential impact of rate cuts on the stock market, it is crucial to understand the dynamics that shape this relationship. While traditional economic theory suggests that rate cuts are bullish for stock performance, the reality is not always as straightforward.

Historically, when central banks cut interest rates, it is often seen as a positive signal for the economy. Lower interest rates can stimulate borrowing and spending, leading to increased corporate profits and stock prices. As a result, investors tend to view rate cuts as a bullish indicator, prompting a rally in the stock market.

However, the correlation between rate cuts and stock performance is not always clear-cut. In some cases, rate cuts may signal underlying economic weaknesses or concerns about future growth prospects. This can lead to increased market volatility and uncertainty, dampening investor sentiment and causing stock prices to decline.

Moreover, the impact of rate cuts on stock performance can vary depending on the timing and magnitude of the cuts. If rate cuts are perceived as preemptive measures to avert a potential economic downturn, they may be met with optimism by investors. On the other hand, if rate cuts are interpreted as reactive responses to an already weakening economy, they may be viewed as a signal of distress, triggering a negative market reaction.

Furthermore, the effectiveness of rate cuts in boosting stock performance also hinges on various external factors, such as global economic conditions, trade tensions, and geopolitical events. These factors can override the influence of rate cuts on stock prices, leading to unpredictable market reactions.

In conclusion, the relationship between rate cuts and stock performance is multifaceted and nuanced. While rate cuts are generally perceived as favorable for stock prices, their impact can be influenced by a myriad of factors that shape market dynamics. Investors should exercise caution and consider the broader economic landscape when evaluating the implications of rate cuts on stock performance. By staying informed and adopting a diversified investment strategy, investors can navigate the complexities of rate cuts and make informed decisions in an ever-evolving market environment.