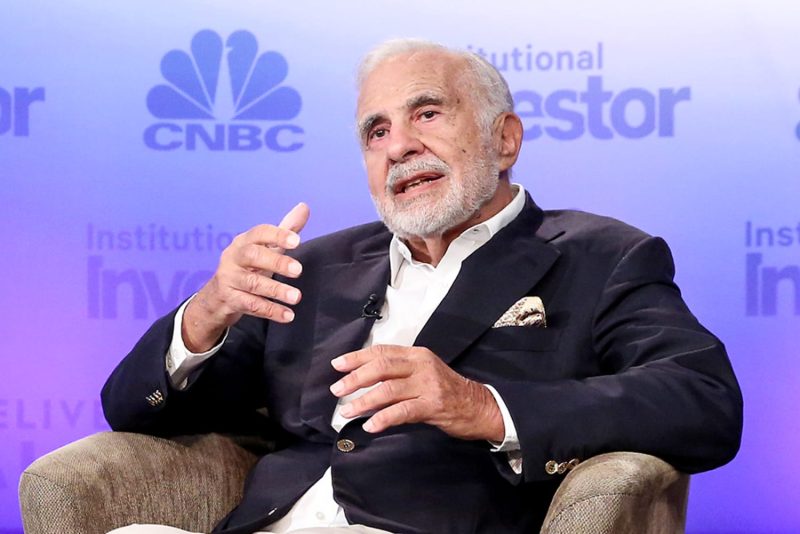

In a shocking turn of events, renowned investor Carl Icahn has found himself at the center of a legal battle with the Securities and Exchange Commission (SEC) for allegedly concealing billions of dollars worth of stock pledges. The charges brought against Icahn have raised significant concerns in the financial world, as Icahn has long been hailed as one of the most successful and influential investors on Wall Street.

The SEC’s allegations revolve around Icahn’s failure to disclose his substantial stock pledges in various companies. Stock pledges are commonly used by investors as collateral for loans, and failing to disclose these pledges can have serious implications for the transparency and integrity of the financial markets. In Icahn’s case, the SEC claims that he entered into swap agreements that effectively pledged his ownership stakes in public companies as collateral for margin loans.

The SEC asserts that Icahn failed to disclose these pledges in a timely and accurate manner, thereby misleading investors and creditors about the true extent of his financial obligations. By concealing these stock pledges, Icahn allegedly violated federal securities laws that require transparency and honesty in financial dealings.

Icahn, known for his activist investing strategies and outspoken views on corporate governance, has built a reputation as a fearless and successful investor. His investment decisions have often moved markets and influenced the direction of major companies. However, the SEC’s charges against him have cast a shadow over his legacy in the financial world.

The case against Icahn raises important questions about the responsibilities and obligations of high-profile investors in disclosing their financial activities. Transparency and accountability are essential principles in maintaining the integrity of the financial markets, and any violations of these principles can have far-reaching consequences.

As the legal battle between Icahn and the SEC unfolds, the investing community will be closely watching to see how the case develops and what implications it may have for the future of investor disclosures. The outcome of this case could have significant repercussions for Icahn’s legacy as an investor and could set a precedent for how stock pledges are treated in the financial industry.

In conclusion, the charges brought against Carl Icahn by the SEC for allegedly hiding stock pledges worth billions of dollars have sent shockwaves through the financial world. The case highlights the importance of transparency and accountability in financial dealings and raises critical questions about the responsibilities of high-profile investors. As the legal battle progresses, the investing community will be eagerly awaiting the outcome and its potential implications for investor disclosures and market integrity.