Market sentiment plays a critical role in determining the direction of asset prices and overall market performance. Investors and traders closely monitor various sentiment indicators to gain insight into market trends and potential turning points. In the current volatile market environment, three key sentiment indicators are pointing towards a bearish phase, raising concerns among market participants.

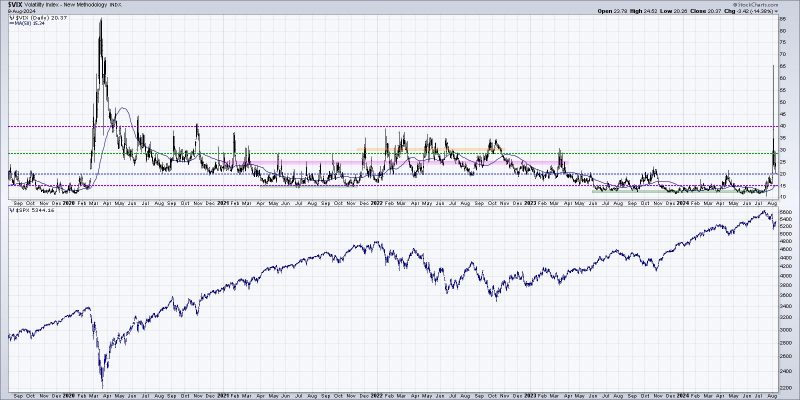

The first market sentiment indicator confirming a bearish outlook is the CBOE Volatility Index (VIX), often referred to as the fear gauge. The VIX measures market volatility and investor expectations for future price fluctuations. A rising VIX typically indicates increased uncertainty and fear among market participants, leading to higher expectations for market downside. As the VIX continues to trend higher, it suggests a growing sense of unease and risk aversion in the market.

Another important sentiment indicator signaling a bearish phase is the Investors Intelligence Bull-Bear Ratio. This widely followed indicator measures the sentiment of investment advisors and newsletter writers, gauging the ratio of bullish to bearish sentiment in the market. A high bull-bear ratio indicates excessive optimism and a potential overbought market condition. Conversely, a low ratio suggests growing bearish sentiment and a possible market correction on the horizon. The recent decline in the bull-bear ratio points towards a shift in sentiment towards a more cautious and bearish outlook.

The third key market sentiment indicator confirming a bearish phase is the AAII Investor Sentiment Survey. This survey polls individual investors on their short-term outlook for the market, capturing sentiment trends among retail investors. A significant increase in bearish sentiment among individual investors can serve as a contrarian indicator, signaling a potential buying opportunity as market pessimism reaches extremes. The latest survey results show a notable uptick in bearish sentiment, indicating a growing apprehension and wariness among retail investors.

In conclusion, the convergence of these three market sentiment indicators – the VIX, Investors Intelligence Bull-Bear Ratio, and AAII Investor Sentiment Survey – all point towards a bearish phase in the market. Investors and traders should exercise caution and remain vigilant in the face of heightened uncertainty and downside risks. By closely monitoring these key sentiment indicators, market participants can better navigate volatile market conditions and position themselves accordingly to weather potential downturns.