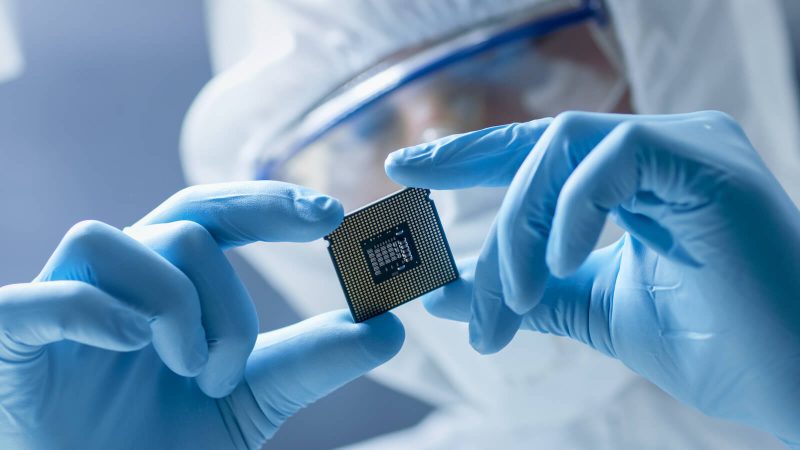

Semiconductors continue to play a critical role in our modern world, powering everything from smartphones to artificial intelligence, making them a focal point for investors. The semiconductor industry has seen its fair share of ups and downs, with recent fluctuations causing concern among investors. The VanEck Vectors Semiconductor ETF (SMH) has experienced a recent downturn, prompting many to question whether now is the right time to buy into this sector.

One key factor influencing the semiconductor market is the ongoing global chip shortage. This shortage, exacerbated by the COVID-19 pandemic and geopolitical tensions, has put pressure on semiconductor manufacturers to meet the growing demand for chips. As a result, many companies in the industry have faced challenges in ramping up production to keep up with market needs. Despite this, the long-term outlook for semiconductor demand remains robust, driven by trends such as the Internet of Things, 5G technology, and electric vehicles.

Investors looking to capitalize on this potential growth opportunity may see the current dip in semiconductor stocks as a good buying opportunity. By investing in an ETF like SMH, investors can gain exposure to a diversified portfolio of semiconductor companies, spreading out risks associated with individual stock holdings. The ETF includes major players in the semiconductor industry, such as NVIDIA, Intel, and Taiwan Semiconductor Manufacturing Company (TSMC), providing investors with broad exposure to the sector.

Moreover, semiconductor companies are at the forefront of technological innovation, with ongoing advancements in areas like AI, cloud computing, and autonomous vehicles driving demand for their products. As industries continue to digitize and adopt more sophisticated technologies, the need for high-performance semiconductors will only grow, presenting a compelling investment case for the long term.

However, it’s essential for investors to exercise caution and conduct thorough research before diving into the semiconductor market. Volatility and external factors like regulatory changes, trade tensions, and supply chain disruptions can impact the performance of semiconductor stocks. By keeping a diversified portfolio and staying informed about industry trends and developments, investors can position themselves for potential growth while managing risks effectively.

In conclusion, while the recent downturn in semiconductor stocks may cause some to hesitate, the long-term prospects for the industry remain promising. Investing in ETFs like SMH can provide investors with exposure to a diversified portfolio of semiconductor companies, allowing them to capitalize on the sector’s growth potential. By staying informed, exercising caution, and conducting thorough research, investors can navigate the semiconductor market effectively and potentially benefit from the ongoing technological advancements shaping our world.