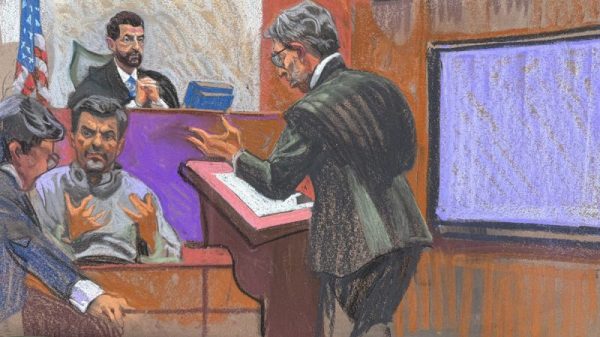

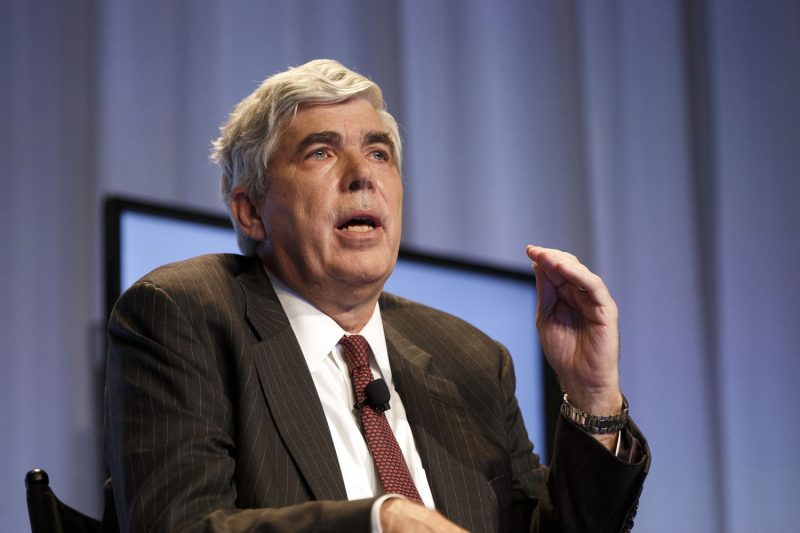

In a recent development that has sent shockwaves through the financial sector, former WAMCO executive Kenneth Leech has been charged by U.S. authorities with multiple counts of fraud. The allegations levied against Leech paint a troubling picture of deceit and manipulation within the company, raising serious concerns about ethics and accountability in the corporate world.

According to the indictment, Leech is accused of engaging in a complex scheme to defraud investors and regulators by providing false information about WAMCO’s financial health and performance. This deceit, which reportedly spanned several years, ultimately resulted in significant financial losses for investors and damaged the reputation of the company.

The charges against Leech are a stark reminder of the importance of transparency and integrity in the financial industry. Investors rely on accurate and truthful information to make informed decisions about where to put their money, and any attempt to deceive them is a betrayal of that trust.

The case also highlights the need for robust regulatory oversight to prevent and detect fraudulent activities. While the details of Leech’s alleged misconduct are still emerging, it is clear that stricter safeguards and monitoring mechanisms must be put in place to prevent similar incidents in the future.

Moreover, the repercussions of such fraudulent behavior extend beyond just financial losses. The erosion of trust in the corporate sector can have far-reaching implications, impacting not only investors but also employees, customers, and the broader economy.

As the legal proceedings against Kenneth Leech unfold, it is crucial for both regulators and industry stakeholders to closely examine the practices and culture within companies like WAMCO to identify and address any systemic issues that may have enabled this fraud to occur.

This case serves as a cautionary tale for corporate leaders and executives, underscoring the importance of ethical conduct and accountability in business. The consequences of deception and fraud can be devastating, both for individuals directly involved and for the wider community affected by the fallout.

Ultimately, the charges against Kenneth Leech should serve as a wake-up call for the financial industry, prompting a renewed commitment to honesty, transparency, and responsible governance. Only by upholding the highest ethical standards can companies build and maintain the trust needed to thrive in today’s competitive and interconnected business environment.