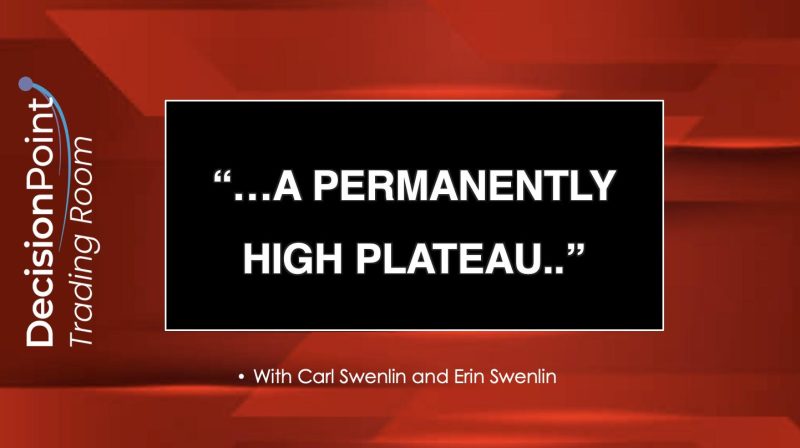

The article discusses the concept of a permanently high plateau in relation to the stock market, drawing insights from historical events such as the Great Depression and the Dot-Com Bubble. The hypothesis of a permanently high plateau implies that stock prices would not experience significant declines or corrections and would instead remain at consistently high levels. However, this theory has been challenged by various market events that have demonstrated the cyclical and volatile nature of the stock market.

One of the key arguments supporting the idea of a permanently high plateau is the concept of long-term economic growth and progress. Proponents of this theory believe that as economies grow and innovate, stock prices will continue to rise steadily over time. They argue that advancements in technology, productivity, and globalization contribute to sustained market expansion, leading to a stable and prosperous environment for investors.

On the other hand, critics of the permanently high plateau theory point to historical stock market crashes as evidence of its fallacy. The Great Depression of the 1930s and the Dot-Com Bubble burst in the early 2000s are cited as examples of major market downturns that disproved the notion of perpetual growth. These events demonstrated the susceptibility of stock prices to external shocks, speculative bubbles, and unsustainable valuations that ultimately led to significant market corrections.

Moreover, the concept of a permanently high plateau overlooks the inherent cyclical nature of the stock market. Market cycles consist of periods of growth, peak, decline, and recovery, reflecting the dynamic interplay of various economic factors and investor behaviors. The boom-and-bust cycles in stock prices highlight the ebb and flow of market sentiment, risk appetite, and valuation metrics that shape the trajectory of stock market movements.

Furthermore, the notion of a permanently high plateau raises concerns about complacency and overconfidence among investors. Believing in the perpetual upward trajectory of stock prices may lead to imprudent risk-taking, speculative investment decisions, and a lack of preparedness for potential market downturns. It is essential for investors to maintain a balanced and diversified portfolio, adopt a long-term perspective, and exercise caution in response to market volatility and uncertainty.

In conclusion, while the concept of a permanently high plateau offers a compelling vision of uninterrupted stock market growth, it fails to account for the cyclicality, volatility, and unpredictable nature of financial markets. Historical events and market dynamics have shown that stock prices are subject to fluctuations, corrections, and bear markets, challenging the notion of perpetual stability. Investors should remain vigilant, adaptive, and informed to navigate the complexities of the stock market and achieve their financial goals in a dynamic and ever-changing investment landscape.