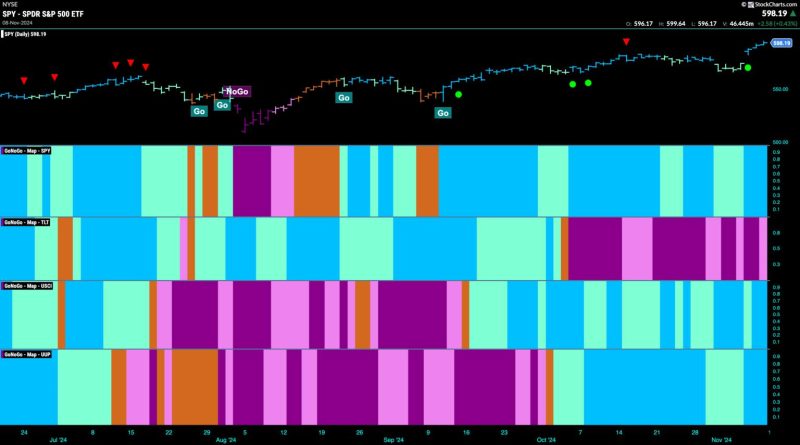

In recent times, the financial market has witnessed a significant surge in the strength of equity go-trend, propelled by a robust performance from the financial sector. This trend reflects a broader positive sentiment among investors as well as an optimistic outlook for the economy.

One of the key drivers behind the surge in equity go-trend is the strong performance of financial institutions. Banks and other financial firms have seen their stock prices rise steadily, supported by solid earnings growth and favorable economic conditions. The increased profitability of these firms has boosted investor confidence in the sector, leading to higher demand for financial stocks.

Another factor contributing to the strength of equity go-trend is the overall positive sentiment prevailing in the market. Despite the challenges posed by the global pandemic and other economic uncertainties, investors have remained largely optimistic about the future outlook for equities. This positive sentiment has translated into increased buying activity, further driving up stock prices across various sectors.

Moreover, the equity go-trend has also been supported by a wave of new investors entering the market. Retail investors, in particular, have been active participants in the recent rally, attracted by the potential for high returns in the equity market. The influx of new investors has brought additional liquidity to the market, creating a favorable environment for further price appreciation.

Furthermore, the emergence of innovative financial products and services has also played a role in driving the equity go-trend. Fintech companies and other disruptors in the financial industry have introduced new investment opportunities and trading platforms, making it easier for investors to participate in the market. These developments have contributed to the overall vibrancy of the equity market, attracting even more interest from investors.

In conclusion, the surge in strength of the equity go-trend, particularly driven by the financial sector, reflects a positive outlook for the market as a whole. With strong performances from financial institutions, positive market sentiment, increased investor participation, and innovative financial products, the equity market is poised for further growth and expansion. Investors should continue to monitor these trends closely and consider the opportunities presented by the evolving landscape of the financial markets.