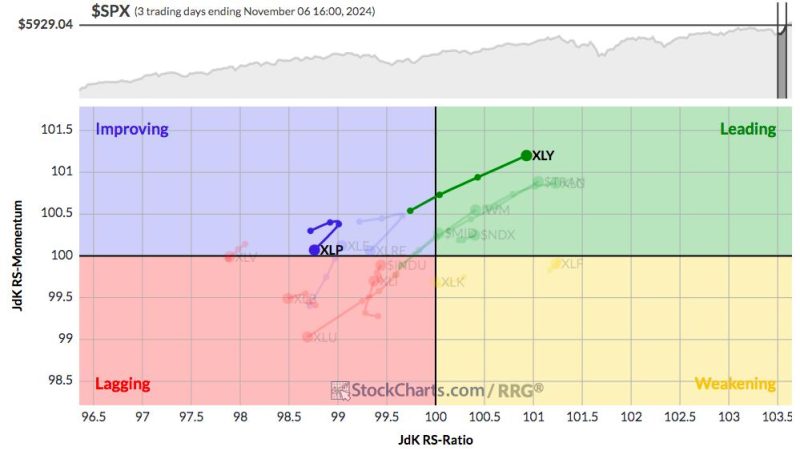

Secular Bull Market Continues But With Major Rotation

The global financial markets have been witnessing a secular bull market over the past few years. This prolonged upward trend has been driven by various factors such as robust economic growth, low interest rates, and ample liquidity in the system. However, recent developments suggest that the secular bull market is facing a major rotation.

One of the key indicators of this rotation is the changing leadership in the market. Traditional growth sectors like technology, healthcare, and consumer discretionary have been replaced by cyclical sectors such as energy, financials, and industrials. This shift in market leadership indicates a change in investor sentiment and expectations for the future.

The rotation in market leadership can be attributed to a number of factors. As the global economy continues to recover from the pandemic-induced slowdown, investors are shifting their focus towards sectors that are expected to benefit from the economic reopening. This has led to increased demand for stocks in sectors like energy and industrials, which are closely tied to economic growth.

Another factor driving the rotation in market leadership is the reflation trade. Central banks around the world have implemented unprecedented monetary stimulus measures to support the economy during the pandemic. This has led to concerns about rising inflation and interest rates, prompting investors to seek out sectors that are better positioned to navigate a higher inflation environment.

The rotation in market leadership is also reflected in the performance of value stocks versus growth stocks. Value stocks, which tend to outperform during periods of economic recovery, have been outpacing growth stocks in recent months. This is a clear indication that investors are favoring stocks with attractive valuations and solid fundamentals over high-growth, high-valuation stocks.

Despite the major rotation in market leadership, the secular bull market is expected to continue. The underlying economic fundamentals remain strong, with global growth projected to rebound sharply in the coming years. Additionally, central banks are likely to maintain their accommodative stance, providing further support to financial markets.

Investors should pay close attention to the changing dynamics in the market and adjust their portfolios accordingly. Diversification across sectors and asset classes can help mitigate risk and capture opportunities arising from the ongoing rotation in market leadership. By staying informed and maintaining a long-term perspective, investors can navigate the evolving market environment and continue to benefit from the secular bull market.