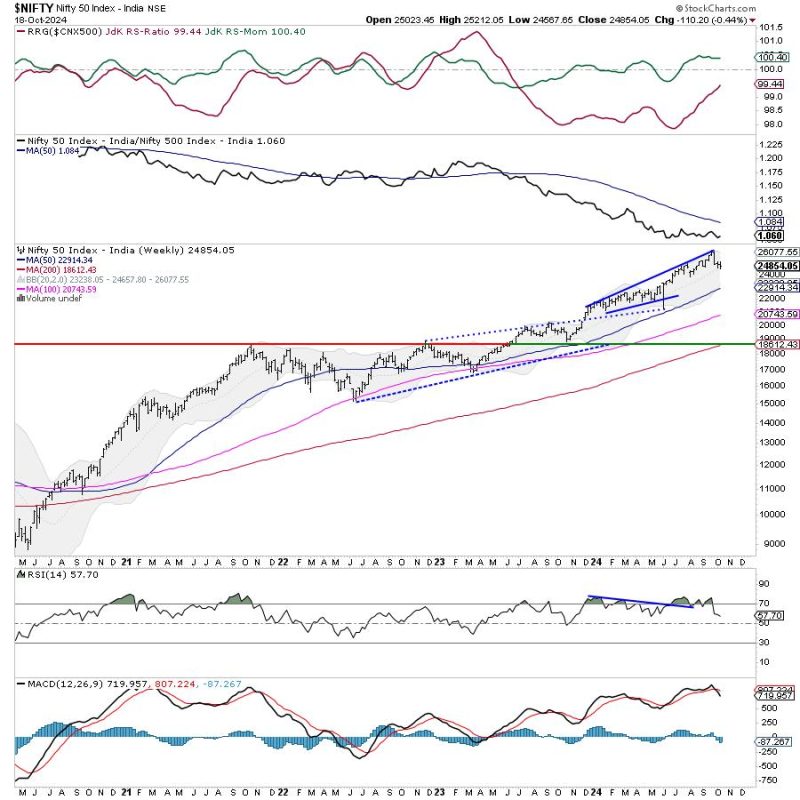

As the trading week ahead unfolds, market participants are likely to observe a range-bound movement in the Nifty index. While significant trending moves may remain elusive, key levels on the index could serve as crucial reference points for potential shifts in market sentiment. In this article, we delve into the analysis presented on Godzillanewz.com and explore the intricacies of the market dynamics at play.

The Nifty index, a barometer of the Indian stock market, is expected to exhibit a consolidative phase in the coming days. This consolidation is anticipated to be characterized by a lack of strong directional biases, with the index oscillating between predefined support and resistance levels. Market analysts suggest that the Nifty may exhibit a range-bound behavior unless certain crucial edges are breached decisively.

One of the primary levels to watch for is the resistance level near the recent swing highs. A breach above this resistance zone could potentially signal a bullish breakout, paving the way for a sustained upward momentum in the Nifty index. Conversely, failure to surpass this resistance level might lead to a continuation of the ongoing sideways movement.

On the flip side, market participants are advised to pay close attention to the support level near recent swing lows. A breach below this support zone could trigger a bearish breakdown, prompting a downward trajectory in the index. However, a bounce off this support level could reinforce the prevailing range-bound structure, offering opportunities for nimble traders to capitalize on intraday fluctuations.

In addition to the technical levels, various fundamental factors could influence the direction of the Nifty index in the week ahead. Market participants are advised to stay attuned to key economic indicators, corporate earnings releases, and global macroeconomic developments that could impact market sentiment and drive volatility in the stock market.

In conclusion, while the Nifty index may exhibit a range-bound behavior in the upcoming trading week, the potential for trending moves exists if critical edges are breached convincingly. Traders and investors are encouraged to remain vigilant, adapt to evolving market conditions, and employ sound risk management strategies to navigate the dynamic landscape of the stock market successfully. By staying informed, patient, and disciplined, market participants can position themselves to capitalize on possible opportunities and mitigate potential risks in the ever-changing financial markets.