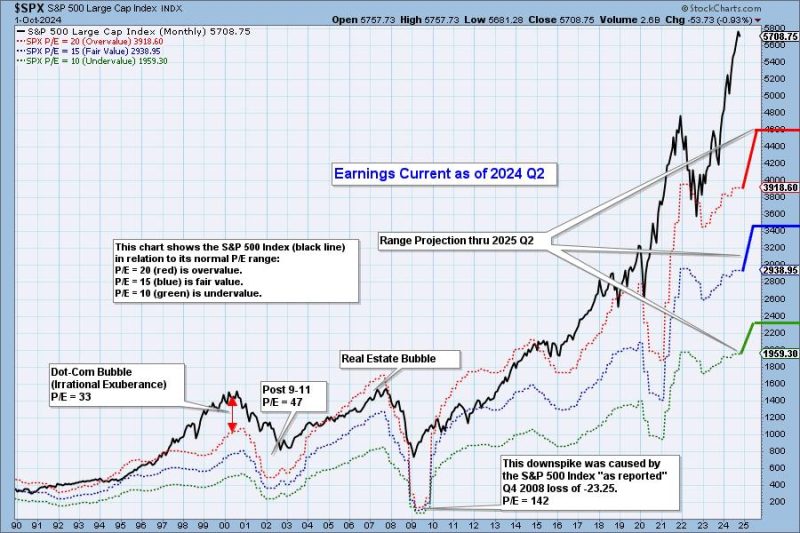

The article discusses the current state of the market following the release of the second-quarter earnings for 2024. Despite the positive performance reflected in the earnings reports, there are concerns about the market being overvalued. This has prompted investors to reevaluate their investment strategies and consider the potential risks involved in an overvalued market.

One major factor contributing to the overvaluation of the market is the rapid pace of economic growth. The strong economic data, including GDP growth and corporate earnings, have driven stock prices higher. However, some analysts argue that this growth may not be sustainable in the long term, leading to a potential market correction.

Another concern highlighted in the article is the impact of rising inflation on market valuations. Inflationary pressures have been on the rise, driven by factors such as supply chain disruptions, increased demand, and rising energy prices. The Federal Reserve’s efforts to combat inflation by raising interest rates could potentially dampen market sentiment and lead to a reevaluation of asset prices.

Furthermore, the article points out the risks associated with high valuation multiples in certain sectors of the market. Technology and growth stocks, in particular, have been trading at lofty valuations, raising questions about their sustainability in the face of changing market dynamics. Investors are advised to exercise caution and diversify their portfolios to mitigate potential risks in an overvalued market.

Despite the concerns raised in the article, there are still opportunities for investors to navigate the current market challenges. Adopting a disciplined investment approach, conducting thorough research, and staying informed about market trends can help investors make informed decisions in uncertain market conditions. Additionally, seeking the guidance of financial advisors and experts in the field can provide valuable insights and strategies to navigate an overvalued market successfully.

In conclusion, the article emphasizes the need for investors to remain cautious and vigilant in the face of an overvalued market. By staying informed, conducting thorough analysis, and diversifying their portfolios, investors can position themselves to weather potential market corrections and uncertainties effectively. As the market continues to evolve, investors must adapt their strategies and make prudent investment decisions to navigate the challenges and opportunities presented by an overvalued market.