In the ever-evolving world of financial markets, it’s crucial to have a clear understanding of potential scenarios that could impact the performance of key investment assets. One such asset that continues to attract significant attention is the Invesco QQQ Trust (QQQ), an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. With the market constantly in flux, having a well-thought-out scenario analysis can provide valuable insights for investors looking to navigate the dynamic landscape of the stock market.

Examining the current economic backdrop, it’s evident that the global economy is facing a range of uncertainties, including the ongoing impact of the COVID-19 pandemic, inflationary pressures, and geopolitical tensions. These factors have the potential to influence investor sentiment and shape the direction of equity markets, including the tech-heavy Nasdaq-100 Index that QQQ is based on.

In this scenario analysis, we aim to outline a plausible path for the QQQ ETF in the coming months based on a combination of fundamental analysis, technical indicators, and broader market trends. While no prediction can be entirely accurate, the following scenario presents a likely trajectory for QQQ:

Scenario: Bullish Outlook

In this scenario, the global economy experiences a robust recovery, supported by continued fiscal and monetary stimulus measures. Strong corporate earnings and positive economic data drive investor confidence, leading to a sustained rally in tech stocks and the broader equity market. The Nasdaq-100 Index, and by extension, the QQQ ETF, outperform other indices as investors flock to growth-oriented companies.

Key Factors:

– Strong corporate earnings growth in the technology sector propels the QQQ ETF to new highs.

– Positive sentiment around innovative tech companies, particularly in areas such as cloud computing, e-commerce, and artificial intelligence, drives investor interest.

– Increased demand for growth stocks as investors seek higher returns in a low-interest-rate environment.

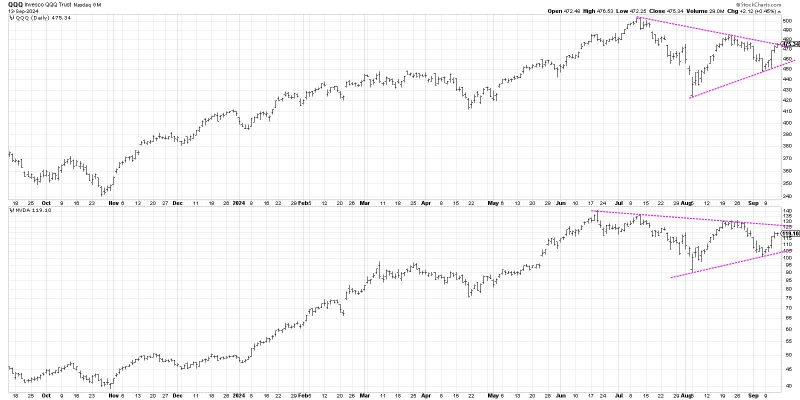

Technical Analysis:

– The QQQ ETF breaks through key resistance levels, signaling a bullish trend.

– Moving averages and momentum indicators confirm the uptrend, supporting further upside potential.

– Strong buying pressure and trading volume indicate broad market participation in the rally.

Risk Factors:

– Rapid inflation or interest rate hikes could lead to a rotation out of growth stocks, impacting the performance of the QQQ ETF.

– Geopolitical tensions or unforeseen events may introduce volatility and uncertainty into the market, potentially tempering gains in tech stocks.

– Regulatory challenges or antitrust concerns could weigh on certain tech companies within the Nasdaq-100 Index, affecting the overall performance of the QQQ ETF.

Conclusion:

While predicting the future performance of the QQQ ETF with absolute certainty is impossible, scenario analysis can help investors anticipate potential outcomes and adjust their investment strategies accordingly. By considering a range of factors, including fundamental drivers, technical indicators, and market trends, investors can make informed decisions in a rapidly changing market environment. Ultimately, staying attuned to the dynamic forces shaping the stock market remains crucial for successfully navigating the complexities of modern-day investing.

By keeping a watchful eye on key developments and conducting thorough scenario analyses, investors can position themselves to capitalize on opportunities while effectively managing risks in their investment portfolios. The QQQ ETF, with its exposure to leading technology companies, remains a compelling option for investors seeking growth opportunities in the ever-evolving world of equities.