The article suggests that the Nifty index is displaying early indications of a likely disruption of its uptrend, cautioning investors to approach the market with care.

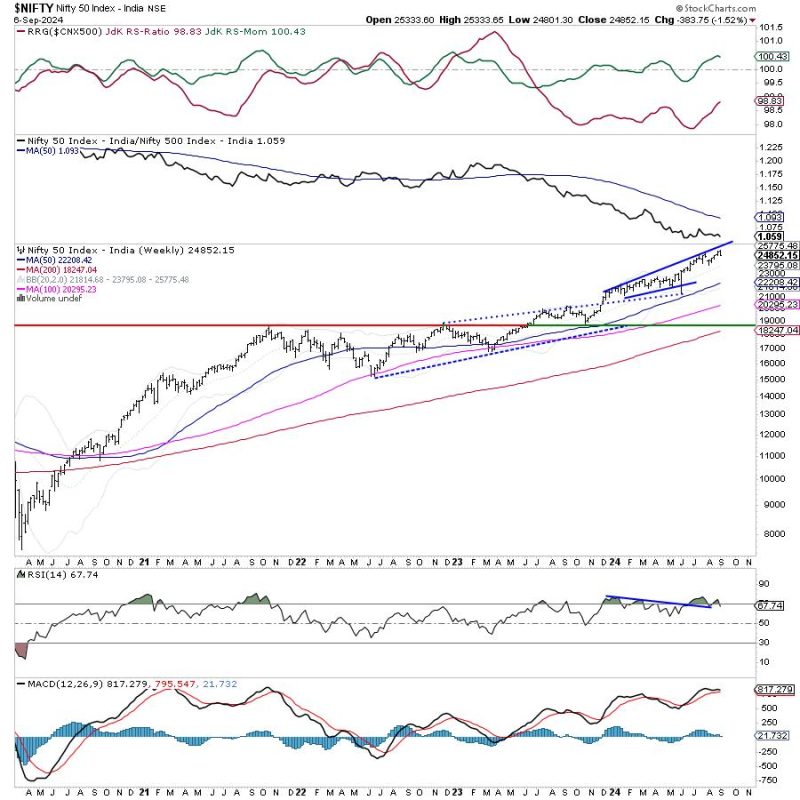

The presentation of the technical indicators in the graph clearly demonstrates the potential shift towards weakening momentum in the market. The Relative Strength Index (RSI) is one of the key indicators showing a divergence, indicating a possible reversal or slowdown in the current trend.

Additionally, the Moving Average Convergence Divergence (MACD) is also signaling a potential bearish crossover in the coming sessions, further reinforcing the notion of a shift in market sentiment.

Furthermore, the article highlights the importance of the support and resistance levels to help traders navigate the market during such uncertain times. These levels act as crucial points that can influence investor behavior and signal potential trend changes.

Moreover, with the announcement of key economic data releases and corporate earnings scheduled for the week ahead, investors are urged to stay vigilant and adapt their strategies accordingly.

In conclusion, the article serves as a valuable reminder for investors to monitor market indicators closely and exercise caution in their trading decisions amidst the early signs of a possible disruption to the uptrend in the Nifty index. By staying informed and adaptable, investors can better position themselves to navigate the market’s changing dynamics effectively.