In a shocking turn of events, a cryptocurrency pig-butchering scam has wreaked havoc on a Kansas bank and led to the imprisonment of the former CEO for a staggering 24 years. The case, which has sent shockwaves through the financial sector, highlights the dangers and complexities of the emerging world of cryptocurrencies and the need for increased vigilance and regulation.

The scheme, masterminded by the bank’s former CEO, involved deceptive practices that preyed on unsuspecting investors looking to capitalize on the booming cryptocurrency market. The perpetrators promised high returns and guaranteed profits, luring in investors with the hope of quick and easy wealth.

However, behind the façade of a legitimate investment opportunity lay a sophisticated web of deceit and manipulation. The CEO and his accomplices used the funds raised from investors to engage in speculative trading and risky investments, ultimately resulting in massive losses for those involved.

The scam reached its climax when it was revealed that the funds raised were being funneled into a pig-butchering operation, a shocking revelation that left investors reeling. The cryptocurrency market, already plagued by volatility and uncertainty, was further rattled by the scandal, as trust in the integrity of the system was severely undermined.

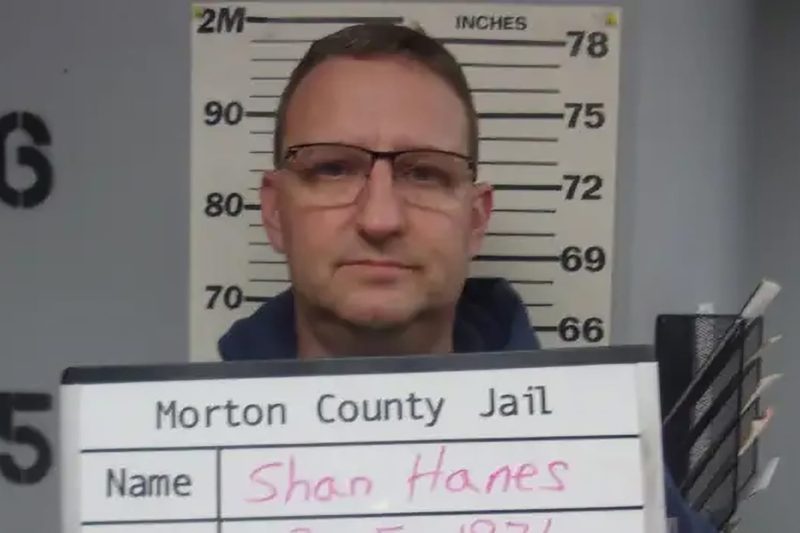

As news of the scandal spread, authorities swiftly moved to investigate and prosecute those responsible. The former CEO, once hailed as a visionary leader in the industry, was sentenced to a lengthy prison term as a consequence of his fraudulent actions. The severity of the punishment reflects the gravity of the crimes committed and serves as a stark warning to others who may seek to exploit the system for personal gain.

The aftermath of the cryptocurrency pig-butchering scam serves as a cautionary tale for both investors and regulators alike. It underscores the importance of due diligence and skepticism when it comes to navigating the volatile world of cryptocurrencies. The incident also highlights the pressing need for robust regulations and oversight to protect investors from falling victim to similar scams in the future.

In conclusion, the case of the cryptocurrency pig-butchering scam serves as a stark reminder of the risks and pitfalls inherent in the world of digital currencies. While the promise of high returns and innovative opportunities may be enticing, it is essential for investors to exercise caution and vigilance to avoid falling prey to fraudulent schemes. By learning from past mistakes and promoting greater transparency and accountability, we can work towards a more secure and trustworthy cryptocurrency ecosystem for all stakeholders involved.