In the world of stock market analysis, technical chart patterns play a crucial role in forecasting potential price movements of various assets. One such pattern that traders often look out for is the double top pattern, which has recently been spotted on the semiconductor sector represented by the Semiconductor ETF (SMH). Let’s delve deeper into this pattern and how traders can interpret and potentially benefit from it.

### What is a Double Top Pattern?

The double top pattern is a bearish reversal pattern that forms after an extended uptrend. It consists of two peaks at approximately the same level, with a trough in between. The pattern signifies a shift in momentum from buying to selling pressure, indicating a possible trend reversal.

### Identifying the Double Top on SMH

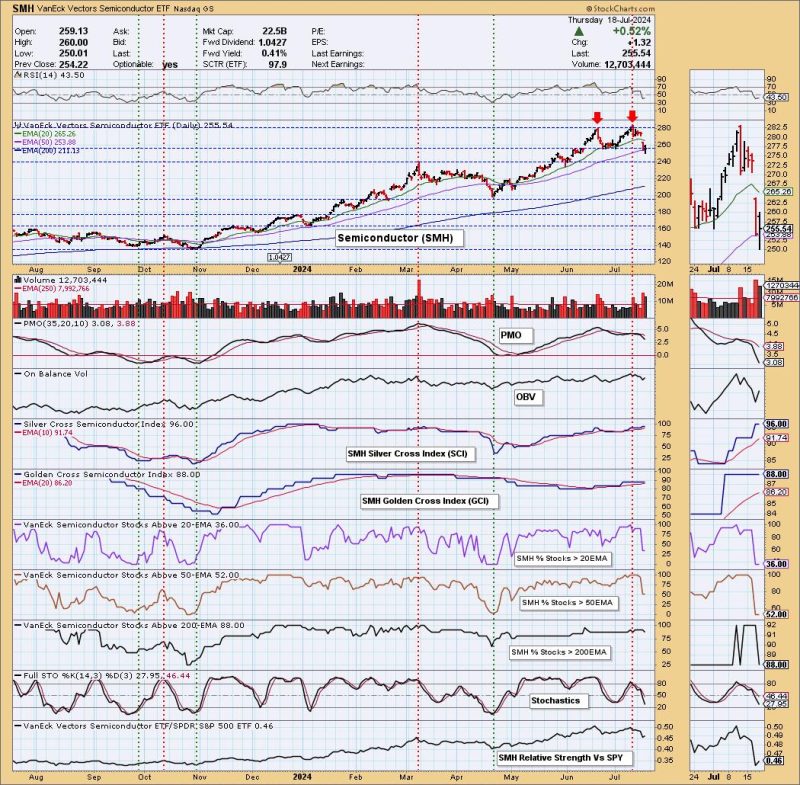

Analyzing the chart of SMH, we notice that the ETF has experienced a strong upward move leading to the formation of the double top pattern. The first peak represents a high point in the price, followed by a pullback (trough), and then a second peak near the same level as the first peak. This configuration forms the characteristic M shape of the double top pattern.

### Implications for Traders

When a double top pattern is confirmed, traders often look for a break below the trough level as a signal to enter short positions, anticipating a further decline in price. The distance between the peaks and the trough can be used to estimate a potential price target for the downward move.

### Risk Management and Confirmation

It is essential for traders to implement proper risk management strategies when trading based on chart patterns. Stop-loss orders can be placed above the second peak to limit potential losses in case the pattern fails to materialize. Additionally, waiting for confirmation in the form of a decisive break below the pattern’s neckline can reduce the likelihood of false signals.

### Monitoring Key Levels

As the double top pattern unfolds on SMH, traders should pay close attention to key support levels below the pattern. These levels can act as potential areas for price reversal or acceleration if breached. Monitoring volume patterns and other indicators can also provide additional confirmation of the pattern’s validity.

### Conclusion

In conclusion, the double top pattern observed on the Semiconductor ETF (SMH) suggests a potential trend reversal in the semiconductor sector. Traders can use this pattern as a guide to anticipate a downside movement in the price of SMH, with proper risk management and confirmation strategies in place. By understanding and utilizing technical chart patterns like the double top, traders can enhance their decision-making process and capitalize on market opportunities.