The recent occurrence of the Hindenburg Omen in the stock market has investors and analysts alike on high alert. This technical indicator has long been considered a foreboding sign of potential market turmoil, with its appearance often sparking fears of a looming downturn. But what exactly is the Hindenburg Omen, and how reliable is it as a predictor of market performance?

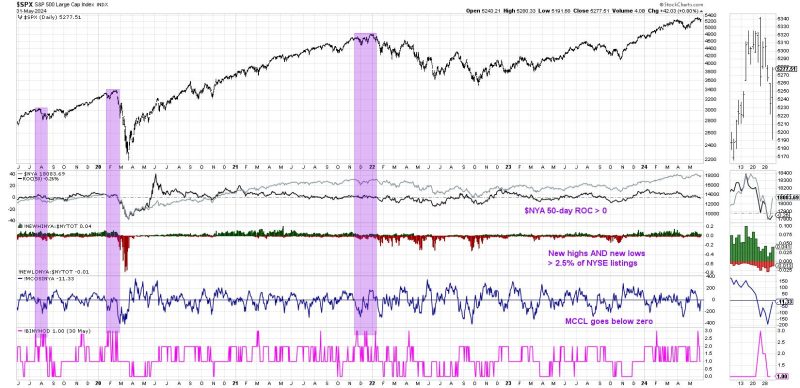

The Hindenburg Omen was first introduced by analyst James Miekka in the mid-1990s. It is named after the infamous Hindenburg airship disaster of 1937, drawing a parallel between the tragic event and potential market crashes. The Omen is triggered when several market conditions align, including a high number of stocks hitting new highs and new lows within a relatively small timeframe. According to proponents of the Hindenburg Omen, this cluster of conflicting signals reflects a market that is deeply unstable and prone to a sudden downturn.

While the Hindenburg Omen has garnered a reputation for signaling impending market turbulence, its track record as a reliable indicator is less clear. Some analysts believe that the Omen is simply a statistical anomaly, pointing out that the criteria for its activation are relatively arbitrary and can be manipulated by external factors. In addition, the Omen has produced false signals in the past, leading many to question its usefulness as a predictive tool.

Despite these criticisms, the Hindenburg Omen remains a point of interest for many investors, who view it as a potential early warning sign of market instability. The recent occurrence of the Omen has certainly raised concerns among market participants, many of whom are closely monitoring key indicators and market trends for signs of a potential downturn.

In conclusion, while the Hindenburg Omen may offer some insight into market sentiment, its reliability as a predictor of market performance is still subject to debate. Investors are advised to approach such technical indicators with caution and consider a range of factors when making investment decisions. As the market continues to evolve, staying informed and maintaining a diversified portfolio remain crucial strategies for weathering market fluctuations.