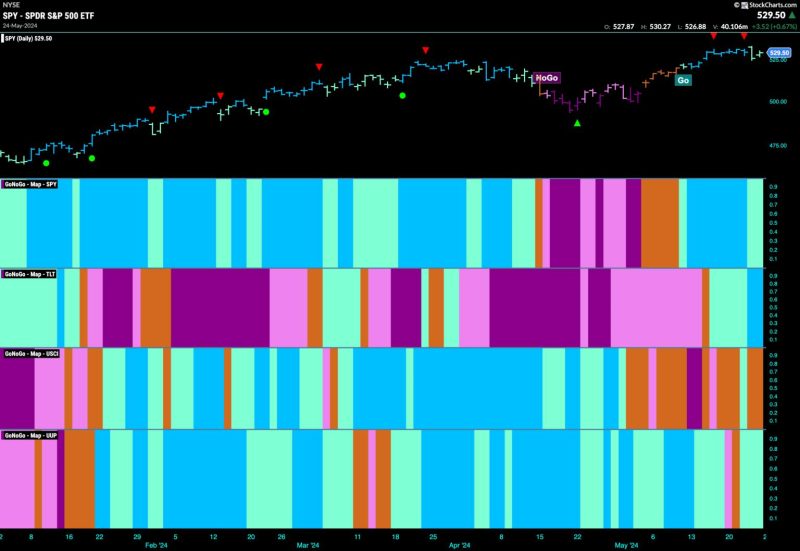

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The broader equities market continues to exhibit a consistent upward trend, buoyed by sturdy performances from sectors beyond tech and utilities. Investors have witnessed a robust rally driven by a blend of industry leadership, economic indicators, and investor sentiment. Despite the intermittent volatility amid ongoing global uncertainties, equities have largely remained on a positive trajectory supported by strong fundamentals and evolving market dynamics.

Rather than relying solely on the traditional stalwarts of the tech and utilities sectors, equities have found new leadership from a diverse array of industries. The shift in market dynamics has instigated a broader group of companies to showcase resilience and growth potential in the face of changing economic conditions. This reinvigorated market diversity underscores a more balanced and sustainable growth path for equities, with multiple sectors contributing to the upward movement.

Healthcare, consumer staples, and industrials are among the sectors that have stepped up to provide leadership in propelling equities forward. The healthcare sector, in particular, has garnered attention for its crucial role in the current global landscape. With the spotlight on healthcare companies driving innovation, finding solutions, and meeting urgent needs, investors have turned their focus towards this sector as a beacon of stability and growth potential.

Moreover, consumer staples have also demonstrated resilience amidst market fluctuations, as consumer spending habits adjust in response to changing dynamics. This sector’s defensive nature and the fundamental need for its products and services have provided a reliable foundation for continued growth and stability within the broader equities market.

Industrials have proven to be another key player in the current equity landscape, with infrastructure development, manufacturing activities, and global trade dynamics influencing market sentiment. Companies within this sector have showcased adaptability and resiliency, navigating supply chain disruptions and shifting demand patterns to sustain growth and drive equities higher.

The evolving leadership landscape within equities reflects a more holistic and diversified market outlook, providing investors with a broader range of options for potential growth and investment opportunities. As tech and utilities maintain their significance within the market, the emerging leadership from other sectors underscores the adaptability and dynamism of the equities market as it responds to changing economic conditions and investor preferences.

Overall, the sustained upward trend in equities remains firmly supported by a combination of factors, including strong sector performances, economic indicators, and investor sentiment. The diverse leadership provided by sectors beyond tech and utilities signifies a maturing market that offers investors a wider array of investment choices and growth prospects. As equities continue on their positive trajectory, investors are encouraged to stay attuned to evolving market dynamics and sector rotations to capitalize on emerging opportunities and navigate potential risks.